As you may know, protecting your business involves more than just purchasing insurance and it is vital that you have an effective risk management strategy in place to protect your people, reduce the likelihood of claims and improve your risk profile. This will make your business more appealing to insurers, helping you to secure better coverage and fewer policy conditions at a better rate during renewal, which is particularly important during the current hard insurance market.

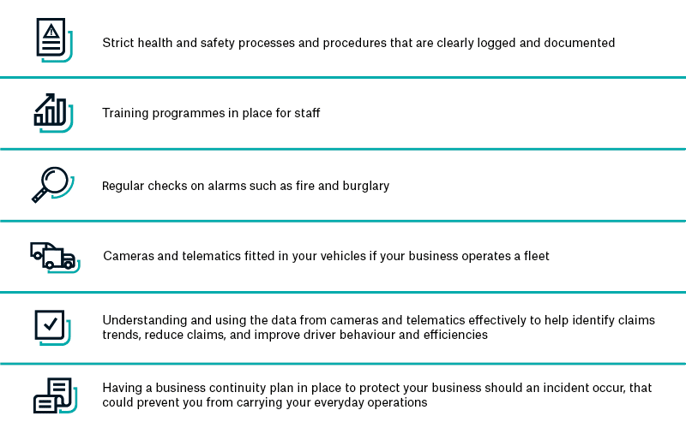

Your business’s risk management strategy will be tailored to your business’s unique requirements which should be discussed and agreed with your insurance broker however, a good risk management strategy should include:

Risk management enhances operational effectiveness, improves resilience, creates employee engagement, and delivers improved business performance. Learn more about our risk management solutions here.

We are here to help

At SRIS, our approach has always been to understand our clients and their risks and, wherever possible, help to mitigate these so claims are kept to a minimum. To further enhance our client's insurance and risk management programmes, we also have partnerships with trusted third-parties who have exclusive offerings for SRIS clients. Find out more here.

Get in touch with our dedicated team to arrange an introductory appointment today:

020 7977 4800

srisenquiries@specialistrisk.com