Rebuild costs

We have had several new clients approach us recently and when reviewing their business’s existing levels of cover, we have identified gaps of over 50% in their commercial property rebuild cost. Insuring your commercial property for an incorrect value or setting your limits too low results in underinsurance, which can have serious and often devastating consequences for businesses. Therefore, in the unfortunate event of a claim policies will not operate as intended, delivering less indemnity than needed following a loss. Ultimately, this could put a business’s ability to recover in jeopardy.

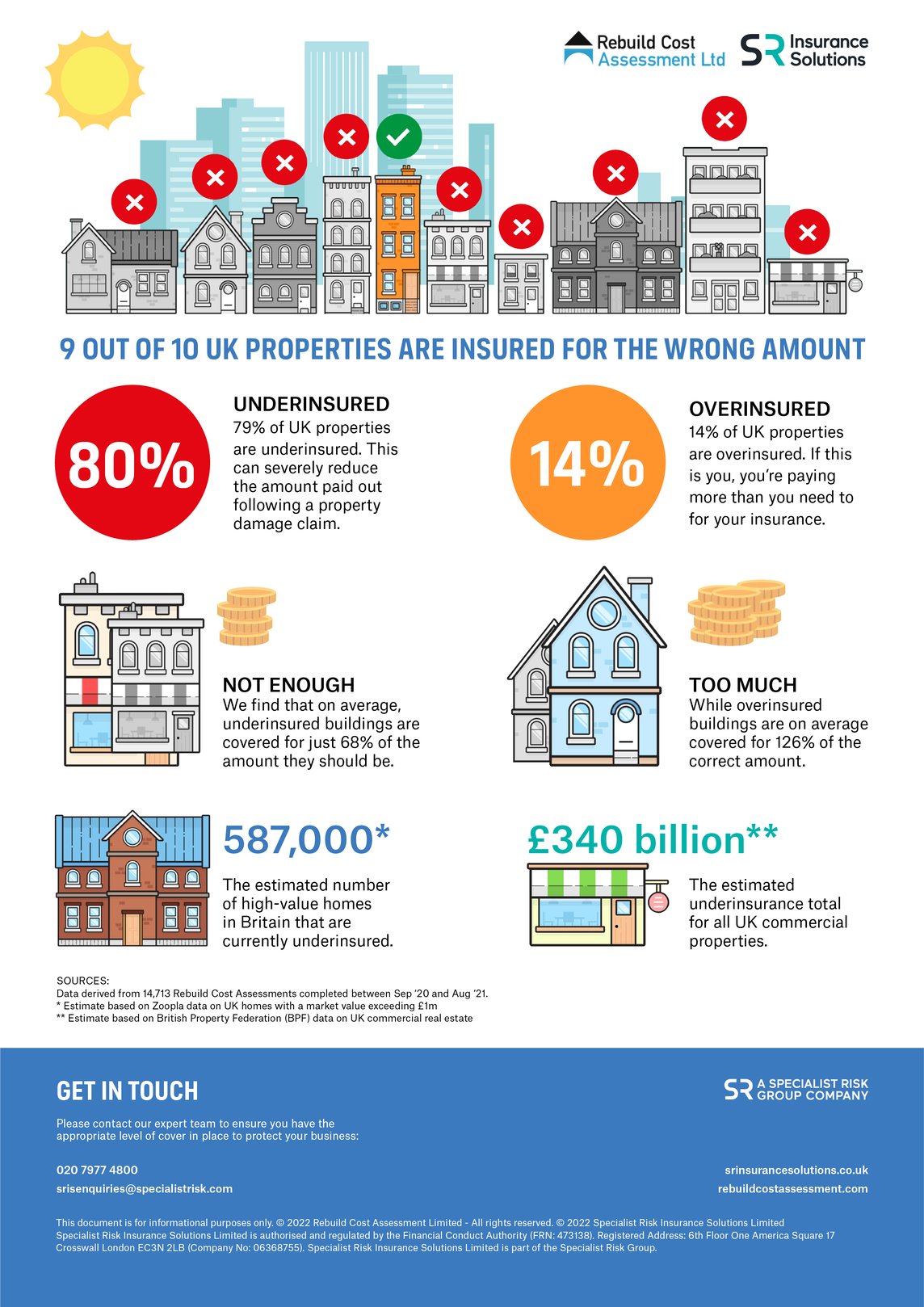

The latest data from RebuildCostASSESSMENT.com reveals a huge shortfall in cover among UK commercial properties, with insurance valuation providers estimating that buildings occupied by businesses in Britain are underinsured by a worrying £340 billion. To help raise awareness of underinsurance in commercial property, we have created this infographic in partnership with RebuildCostASSESSMENT.com:

How we can help

We partner with RebuildCostASSESSMENT.com with a number of our clients to ensure they have the appropriate level of cover in place.

Are you confident that you have the correct level of cover in place to protect your business? Get in touch with our expert team to review your sums insured.